1st term oVer!!! (week 11)

Reduced Form Modeling of CDS

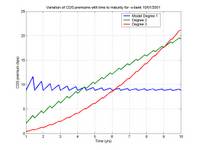

This figure shows how the CDS premiums vary with maturity depending on the degree of polynomial used for the integrated hazard function. The quadratic and cubic terms model that effect, but the linear one doesnt. Note that the sawtooth profile is due to the accrual payments for defaults occuring in-between the premium payment dates.

This figure shows how the CDS premiums vary with maturity depending on the degree of polynomial used for the integrated hazard function. The quadratic and cubic terms model that effect, but the linear one doesnt. Note that the sawtooth profile is due to the accrual payments for defaults occuring in-between the premium payment dates.My group finally turned in the project last night (and we were completely exhausted after 2 days of coding, data analysis and writing). In the end, it was truly worth it. The project exposed us to good concepts in credit and term structure modeling - which is just in time for the next term coursework (which begins next week), which has courses like:

- Derivatives - economic concepts

- Derivatives - Quantitative modeling

- Credit Risk

- Fixed Income

- Accouting for derivatives (elective - I havent registered for this course, but may sit in some classes)

Looking forward to it!!! But I sure wish I had a longer break...

0 Comments:

Post a Comment

<< Home