27/28...

This week was one of the most intense. When two major projects are due in the same week, complete with presentations and reports, and add to it - company presentations and interviews, it can be an super-charged sleep-deprived combination.

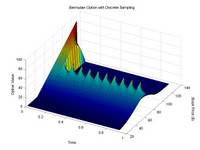

First up, ACF project involved looking at pricing a double barrier option. We looked at quite a few variations including this one shown below - a Bermudan option with discrete sampling of the barrier. The 3d plots make this look really cool - but the technique is exceedingly simple yet very effective.

Bermudan with discrete sampling of the barrier

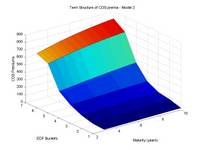

The other project was implementing a reduced form model for the Credit modeling class - we implemented a simple model with deterministic hazard rate function. The CDS term structure from that model are shown below.

Term structure of CDS premiums as a function of EDF buckets

In other news, I am getting ready to pack my bags and head out to my internship in a couple of weeks.... cant wait to get start going to an office again! (j/k)

First up, ACF project involved looking at pricing a double barrier option. We looked at quite a few variations including this one shown below - a Bermudan option with discrete sampling of the barrier. The 3d plots make this look really cool - but the technique is exceedingly simple yet very effective.

Bermudan with discrete sampling of the barrier

The other project was implementing a reduced form model for the Credit modeling class - we implemented a simple model with deterministic hazard rate function. The CDS term structure from that model are shown below.

Term structure of CDS premiums as a function of EDF buckets

In other news, I am getting ready to pack my bags and head out to my internship in a couple of weeks.... cant wait to get start going to an office again! (j/k)

0 Comments:

Post a Comment

<< Home